Global market analysts predict that cross-border transactions will surpass $250 trillion by 2027, a testament to the increasing interconnectedness of our world. For a small business owner, this isn’t just a number; it’s a massive opportunity. The internet has erased borders, making it possible to sell your products to customers on another continent or hire the perfect freelance developer from halfway around the world.

But as your business grows, a critical question arises: how do you manage the money? Relying on personal bank accounts or asking a friend abroad to help you receive funds is not a sustainable strategy. To operate professionally and efficiently in today’s global market, your small business needs a reliable international payment solution. Here’s why it’s a non-negotiable tool for growth.

1. You build trust and professionalism

Imagine you are a client in Germany, ready to pay for a service from a business in Nigeria. One business sends you a clean, branded invoice with a simple link to pay by card or bank transfer. The other sends you their personal account details via WhatsApp and asks you to “just send it.” Which business inspires more confidence?

A dedicated payment solution shows your clients that you are a serious and legitimate enterprise. It provides a secure and professional payment experience, which builds the trust necessary to foster long-term international business relationships.

2. You get paid faster and improve your cash flow

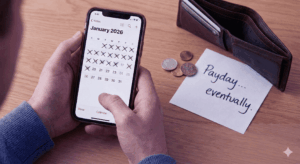

Cash flow is the lifeblood of any small business. Traditional international bank transfers can be painfully slow, sometimes taking five to ten business days for money to arrive, often with no way to track its progress. This waiting period can strain your finances and delay projects.

Modern international payment platforms are built for speed. They bypass many of the slow, traditional banking systems, often allowing you to receive your money in a matter of hours or even minutes. This speed and predictability give you better control over your cash flow, letting you pay your own bills and reinvest in your business without delay.

3. You save significant money on fees and exchange rates

When you receive money through a traditional bank, you often lose a chunk of it in the process. There are high wire transfer fees and, more importantly, unfavorable exchange rates. Banks often build a large margin into their currency conversions, a hidden cost that eats directly into your profits.

A specialized payment solution is built to be more efficient. These platforms offer much more competitive exchange rates—often close to the mid-market rate—and feature transparent, low fees. Over dozens of transactions, this can add up to thousands of dollars in savings for your business.

4. You can access a global talent pool

Growth isn’t just about getting paid; it’s also about being able to pay others. What if the best web designer for your project is in Kenya, or the most skilled virtual assistant is in the Philippines? A reliable payment solution allows you to pay international contractors and freelancers easily and affordably. This empowers you to hire the best talent for the job, no matter where they are located, giving your small business a competitive edge.

5. You simplify your accounting and bookkeeping

Tracking international payments from various clients via different methods can quickly become a nightmare for your bookkeeping. A dedicated payment solution centralizes all your international transactions in one dashboard. You can easily track payments, view transaction histories, issue invoices, and generate reports. This organization simplifies your financial management and makes tax season far less stressful.

In conclusion, moving beyond informal payment methods is a critical step in scaling your business. A reliable international payment solution is an investment in your company’s credibility, efficiency, and future growth. Don’t let outdated payment processes be the barrier that keeps your business from succeeding on the global stage.