meCash Blog

Democratising access to global financial services for Africans.

Articles

Is this a safe space? Is it? Okay, good. Because we need to be honest with ourselves. We are currently in the middle of the longest month in human...

Every business owner knows that specific feeling of “Imposter Syndrome.” You are building a world-class company. Your product is solid...

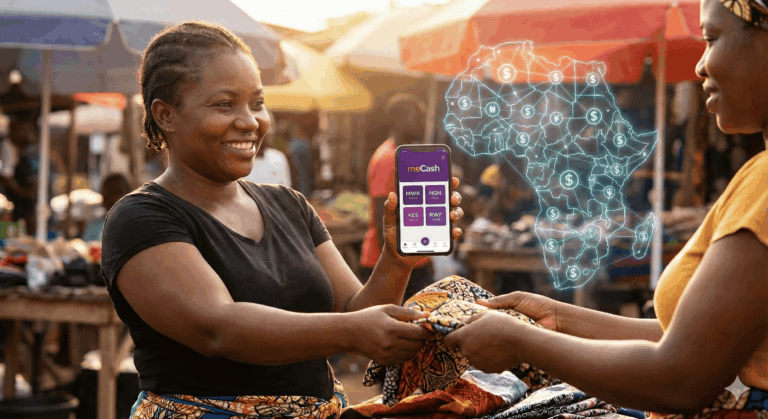

If you are a business owner in Lagos, Lilongwe, Nairobi, or Kigali, you know the frustration of trading within Africa. It is an irony of modern...

Imagine Chimwala. She runs a small textile business in a bustling market in Lilongwe, Malawi. For years, Chimwala’s business existed entirely in...

This is it. The Black Friday and Cyber Monday sales rush is on. Your suppliers in US, and the UK have just dropped their “limited-time”...

The holiday season is here. It is a time for connection, celebration, and showing love, even across continents. You want to send a gift back home to...

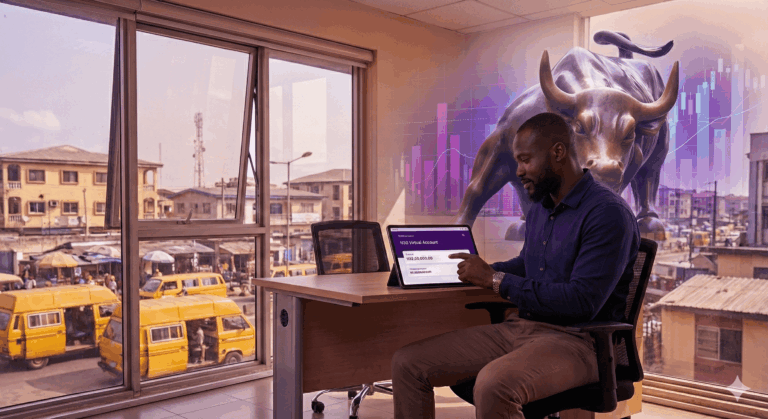

With the meCash API, you can connect international payments, currency conversion, and virtual accounts directly into your own systems — letting your...

In today’s global market, choosing the right payment partner can shape your business’s success. Whether you’re a startup, an SME, or an established...

Salary week is coming. Before you buy that ₦9,000 shawarma platter, order that chowdeck you’ve been eyeing, or buy that shoe from that IG...