Let’s be honest for a second.

Remember when ATMs first showed up? People were scared. “It will swallow my card!” “What if it gives me fake money?”

We laugh about it now, but that fear was real. And today, that same old fear has a new name: digital payments.

You’ve heard the stories. Maybe you even tell them. “My money will just disappear.” “It’s only for techy people.” “Cash is king, man, this online thing is a scam.”

I get it. But most of what we believe about digital payments is based on old news and straight-up myths.

So today, let’s talk. No jargon. No sales pitch. Just you and me, figuring out the truth.

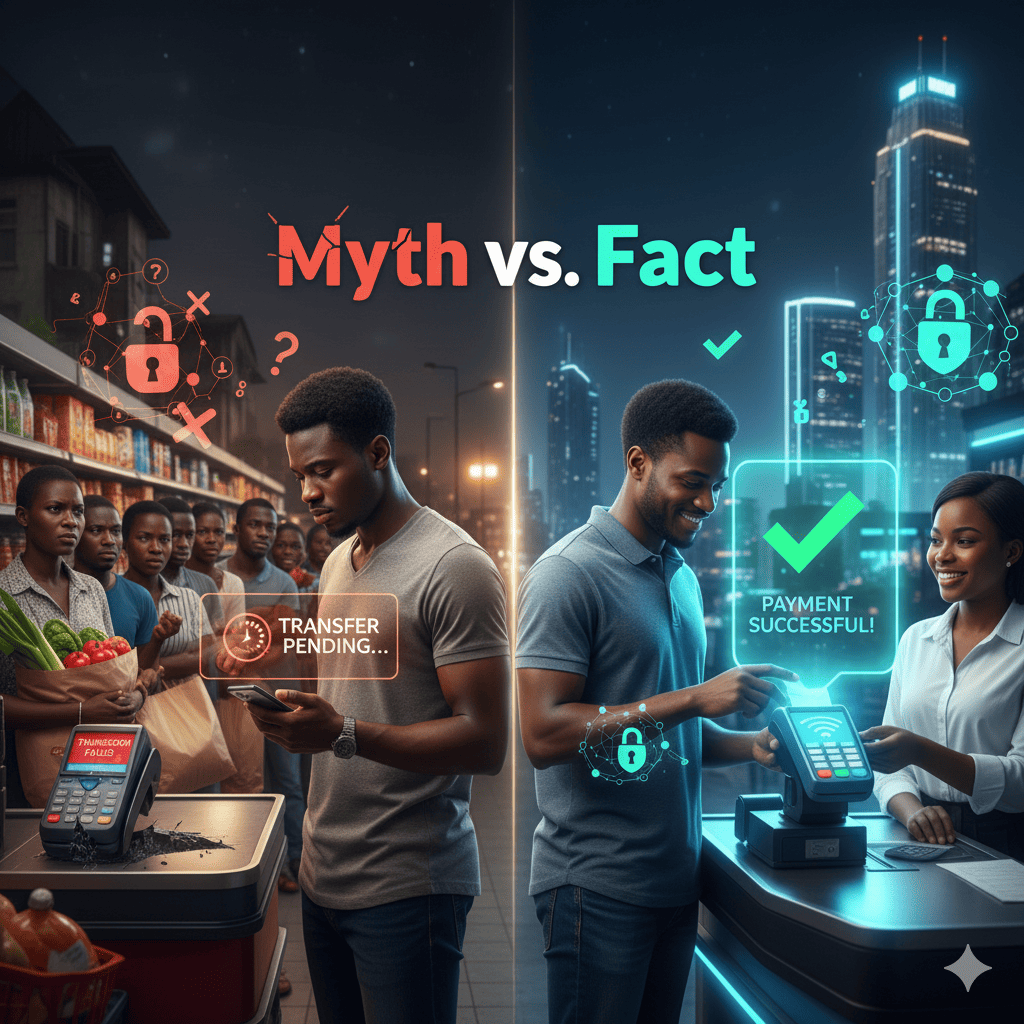

Myth 1: “Digital payments are unsafe. Someone will steal my money.”

This is the big one. The fear that your hard-earned cash will vanish into thin air because you clicked the wrong button.

The Fact:

Reputable digital payment platforms are built like armoured trucks. Seriously. Your information is protected by multiple layers of security, like encryption, which basically scrambles your data into a secret code that even the smartest hacker can’t read.

Believing all digital payments are unsafe is like saying you shouldn’t use WhatsApp because someone once got scammed in a group chat. The problem isn’t the tool; it’s how you use it and who you use it with. Secure platforms like Me-Cash are designed to protect you from the start.

Myth 2: “It’s too complicated. I’m not a tech person.”

You see all the buttons, the talk of “APIs” and “wallets,” and your brain just shuts down. You think, “This is for the kids in Yaba, not for me.”

The Fact:

If you can find the right emoji to send on WhatsApp, you can use modern digital payments. It’s true.

The best financial tools today are designed for humans, not robots. The whole point is to make it easier than going to the bank. Think about it: sending money should be as simple as sending a text message. No long queues, no confusing forms. It’s designed for your mum, your uncle, and the woman selling roasted corn down the street. It’s designed for you.

Myth 3: “Cash is king. Digital payments always fail when you need them most.”

You’re in the supermarket queue. The POS fails. The transfer hangs. You’ve been burned before, and you swear, “Never again. Cash is more reliable.”

The Fact:

Let’s flip that. Is cash really reliable?

You can lose it. It can be stolen. You have to deal with the constant headache of “no change.” You have to travel to a bank to withdraw it.

While no system is 100% perfect, a reliable digital platform is actually more secure and efficient than carrying around wads of cash. Over 70% of Nigerians now use some form of digital payment. Why? Because when it’s built right, it just works. It saves you time, stress, and the risk of your money walking away from your pocket.

So what’s the lesson here?

Most of our fears about digital finance are stuck in the past. The technology has grown up. It’s safer, smarter, and simpler than ever before.

You don’t need to be a tech genius to be safe. You just need to choose the right tools and trust the facts, not the fear.

You can do this.