In today’s global market, choosing the right payment partner can shape your business’s success. Whether you’re a startup, an SME, or an established company expanding across borders, your payment infrastructure affects your costs, cash flow, and customer trust.

From traditional banks to fintech innovators and wallet platforms, the choices can feel overwhelming. Let’s look at how to evaluate them based on cost, speed, APIs, and compliance—and why meCash offers the best of all worlds.

Cost: Understand what you’re really paying

Banks often charge high fees, apply wide FX spreads, and add extra costs through intermediaries. These hidden charges can quickly eat into your margins, especially for cross-border transactions.

Fintechs changed the game by offering lower costs and transparent pricing. They remove intermediaries and use technology to cut transfer expenses.

Wallet providers take this further by enabling low-cost, in-network transfers. However, they may lack strong cross-border capabilities.

meCash stands apart with real-time quotes and full transparency. Before you send money, the Quote API shows your exchange rate, fees, and total cost. You always know exactly what you’re paying—no hidden surprises.

Speed: Move money at the pace of your business

Banks can take three to five days to settle international payments. That delay can slow supplier payments and disrupt your cash flow.

Fintechs are faster, often settling within hours.

Wallet providers can move money instantly within their network but may not support all currencies or countries.

meCash delivers instant or same-day payouts to countries like Nigeria, Malawi, and China, using direct rails that balance speed and security. You send payments fast and track them in real time through webhooks or the dashboard.

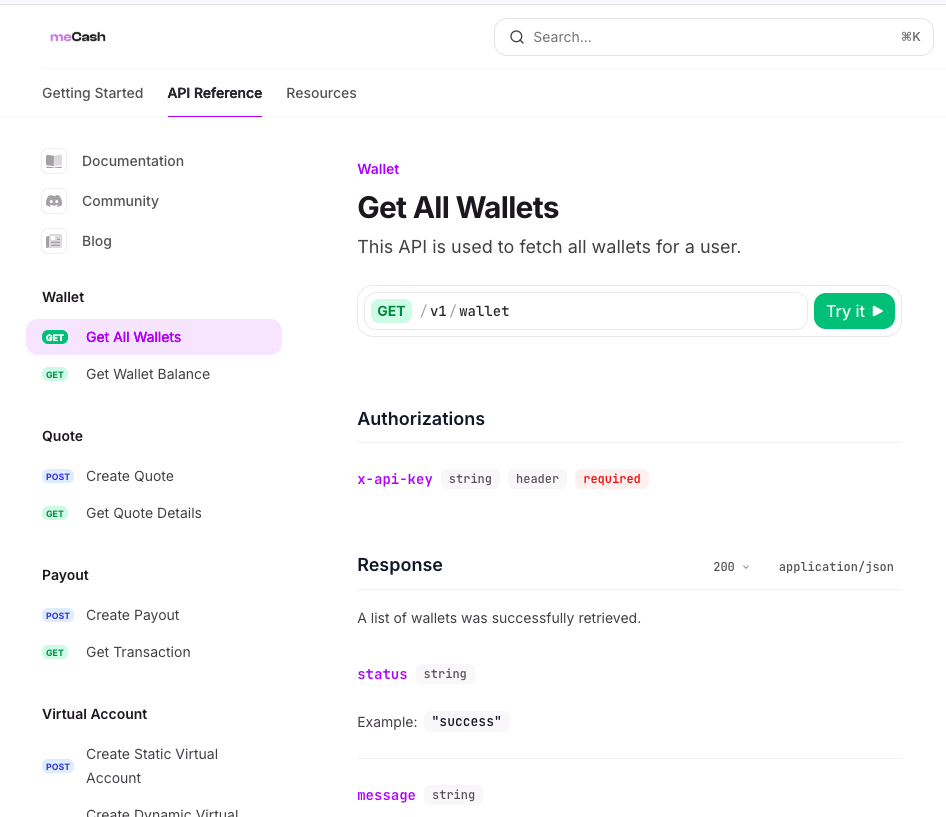

APIs and integration: Build automation that works for you

Banks offer limited APIs and outdated systems that make automation slow and expensive.

Fintechs and wallet platforms offer better integration but often focus on narrow features—either collections or payouts, not both.

meCash gives developers a unified API that handles quotes, payouts, virtual accounts, and webhooks in one place. You can integrate payments directly into your systems for seamless automation.

Want to try it out? Visit the meCash Developer Sandbox to test APIs safely before going live. It’s an interactive environment where your team can simulate real transactions end to end.

Compliance and security: Stay safe while you scale

Banks have strong compliance frameworks but can be rigid, making onboarding slow.

Fintechs vary—some are well-regulated, while others depend on third-party licenses.

Wallet providers often focus on convenience, but not all meet global compliance standards.

meCash is both regulated and developer-friendly. It follows strict KYC, KYB, and AML policies to protect your transactions. You get the trust of a licensed financial institution and the agility of a fintech platform.

Quick comparison

| Criteria | Traditional banks | Fintechs | Wallet providers | meCash |

|---|---|---|---|---|

| Cost | High fees and FX spreads | Lower fees | Low | Transparent quotes, low FX |

| Speed | 1–5 days | Fast | Instant (limited) | Near-instant payouts |

| APIs | Limited or outdated | Modern | Flexible (local only) | Unified API + Sandbox |

| Compliance | Strong but rigid | Varies | Varies | Regulated + agile |

Why meCash is the right partner

meCash combines bank-grade reliability with fintech innovation. It supports multiple currencies, offers instant payouts, and provides transparent quotes. Businesses can integrate through one API, test in the sandbox, and scale confidently across borders.

Key advantages:

- Multi-currency support: NGN, USD, GBP, EUR, MWK, and CNY

- Transparent pricing: Real-time quotes with locked-in rates

- Developer tools: Unified APIs, webhooks, and a live sandbox

- Regulated operations: Built on strong compliance foundations

With meCash, you can send, receive, and reconcile global payments faster, safer, and at a fraction of the cost.

Conclusion

The right payment partner should empower your business, not slow it down. When you weigh cost, speed, APIs, and compliance, meCash delivers on all fronts—helping your business grow without borders.

Start building smarter payments today.

👉 Explore the meCash Developer Docs

👉 Test APIs in the Sandbox Playground

👉 Get started and see how fast global payments can be.