Salary week is coming. Before you buy that ₦9,000 shawarma platter, order that chowdeck you’ve been eyeing, or buy that shoe from that IG vendor.

… stop. Sit down. Let’s make a plan.

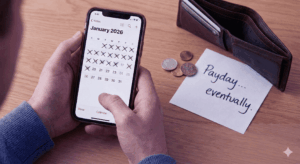

We all know the feeling. The credit alert hits, and suddenly you feel like a millionaire. Your brain switches to “treat yourself” mode, and a few days later, you’re left looking at your balance, wondering how a third of your salary vanished so quickly.

You’re tempted to hit the “If I perish, I perish” button. Let’s be real—with the way the Nigerian economy is set up, you will actually perish.

Your solution is to plan your payday “pre-game.”

You need to decide where your money will go before it even arrives, you move from being a reactive spender to a proactive CEO of your own finances. Here’s your 5-step plan to execute this salary week.

Step 1: The Quick Review (Where did last month’s money go?)

You can’t plan for the future without a quick glance at the past. Open your banking app and scroll through last month’s spending. No judgment, no shame. Just look at the data.

- Did you spend more on data subscriptions than you thought?

- Did that “one-off” app subscription actually renew?

- Where were the big wins and the unexpected costs?

This 10-minute exercise isn’t about making you feel guilty; it’s about giving you the information you need to create a realistic plan for the month ahead.

Step 2: Secure Your “Four Walls”

Before you plan for anything else, you need to ensure your essential needs are covered. These are your non-negotiables, the things you absolutely must pay to live.

- Housing: Rent

- Utilities: Electricity bill, water, waste disposal, and internet

- Transport: Fuel or public transport costs to get to work

- Food: Your essential grocery budget

List these out and total them up. This is the first chunk of your salary that is already spoken for.

Step 3: Give Every Naira a Job

This is where you take full control. The goal is to assign a specific task to every single Naira you earn. This technique, often called a “zero-based budget,” ensures no money is left to just disappear. Your formula is simple:

Income−Expenses−Savings−Debt Repayments=₦0

Your plan might look something like this for a ₦200,000 salary:

- Salary: ₦200,000

- Rent & Utilities (from Step 2): – ₦70,000

- Debt Repayment (e.g., loan app): – ₦15,000

- Savings & Investments: – ₦25,000

- Subscriptions (Netflix, Apple Music): – ₦5,000

- Groceries & Foodstuff: – ₦40,000

- Personal Spending (Fun Money!): – ₦45,000

- Remaining Balance: ₦0

Every Naira has a purpose. Now you know exactly what you have left for personal spending, which brings us to the best part…

Step 4: Plan Your “Wants” Guilt-Free

A budget is not a financial prison. It’s a permission slip to spend on the things you love without feeling guilty. That ₦45,000 for “Personal Spending” in the example above? That’s your money for the shawarma, a night out with friends, new clothes, or even that aso ebi for an upcoming wedding.

Because you’ve already handled your responsibilities, this spending is 100% stress-free. You’re not “stealing” from your savings or bill money. You are enjoying the rewards of your good planning. If you want a more expensive item, you can plan for it by creating a dedicated savings “pot” in your app and allocating money to it each month.

Step 5: Prepare to Execute on Payday

You’ve done the hard work. The plan is set. Now, the final part is preparing to take action the moment the money lands.

- Line up the transfers: Have your banking app open. Know the exact amounts you need to move to your high-interest savings account, your investment app, or to clear that loan.

- Automate it: Even better, turn this monthly plan into standing orders. Set up automatic transfers for the day after payday to move your savings and investment money. This is you looking out for your future self.

When your salary alert finally pings, you won’t feel the urge to splurge impulsively. You’ll feel calm and in control, ready to execute a plan that you designed for your own success. Now go on, enjoy that shawarma – it’s in the budget.