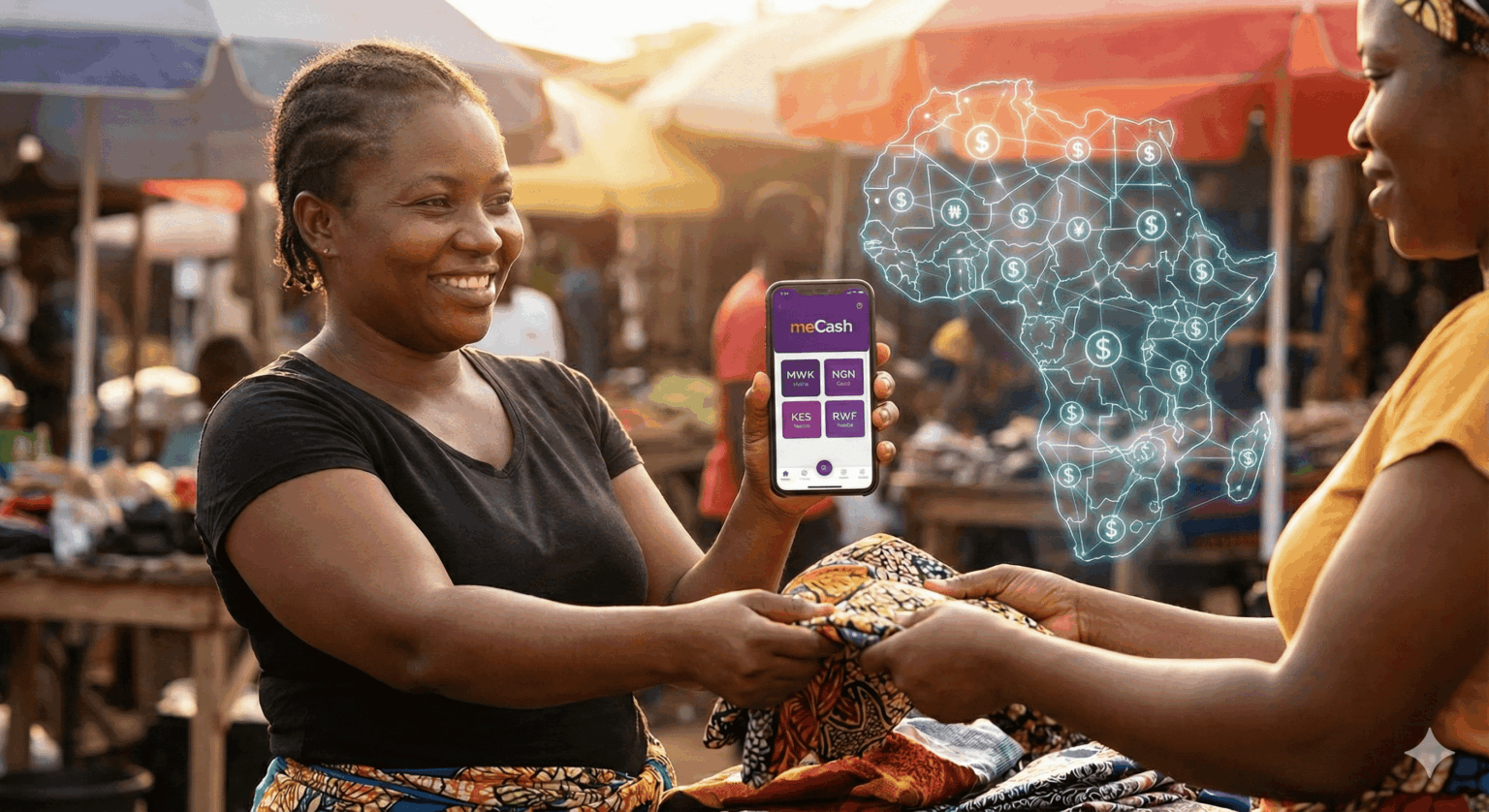

Imagine Chimwala. She runs a small textile business in a bustling market in Lilongwe, Malawi.

For years, Chimwala’s business existed entirely in physical cash—Malawian Kwacha (MWK). Every sale was a handshake, and every saving was a banknote tucked away in a lockbox. She was what economists call “unbanked” or “underbanked.”

But Chimwala had a problem. She wanted to source better fabrics from a supplier in Lagos, Nigeria. In the traditional banking world, this was impossible. Her local bank didn’t speak “Naira.” They asked her to convert her Kwacha to US Dollars first a process that required paperwork she didn’t have, fees she couldn’t afford, and a waiting period that would kill her business momentum.

She was financially excluded. Not because she didn’t have money, but because her money was trapped within her borders.

This is the reality for millions of entrepreneurs across Africa. But the story is changing, and meCash is writing the next chapter.

The Digital Bridge: From Exclusion to Empowerment

Financial inclusion isn’t just about giving someone a bank account number; it’s about giving them access. It is about taking a currency that feels “local”—like MWK or RWF—and giving it global power.

When Amara discovered the meCash app, she didn’t just find a digital wallet; she found a bridge.

For the first time, she could deposit her local MWK into a digital secure vault. She didn’t need a complex paper trail or a minimum balance of thousands of dollars. She just needed her phone.

But the real magic happened when she needed to pay that supplier in Lagos. Through meCash, she didn’t have to hunt for scarce US Dollars. She sent funds from her MWK wallet, and her supplier received Nigerian Naira (NGN) instantly.

The barrier was gone. The “underbanked” market woman in Malawi was now an international importer.

Why “Local” Matters for Inclusion

Most fintechs focus on the giants: the Euro, the Dollar, the Pound. But true financial inclusion in Africa happens when we empower the currencies people actually use to buy bread, pay school fees, and run shops.

meCash focuses specifically on the corridors that have been ignored for too long:

- The Farmer in Rwanda (RWF): Who can now sell produce to neighbors in Kenya without worrying about currency conversion losses.

- The Freelancer in Kenya (KES): Who can work for Nigerian clients and get paid directly into a wallet that makes sense for their local economy.

By supporting MWK, NGN, KES, and RWF natively, meCash validates these economies. We are saying to the unbanked: Your money is good here. Your business matters.

Safety, Dignity, and Data

The impact of this shift goes beyond just trade; it touches on human dignity and safety.

For the unbanked, carrying cash is a physical risk. Theft, fire, or loss can wipe out a lifetime of savings. By moving funds into a meCash wallet, entrepreneurs gain:

- Security: Their capital is protected by encryption, not a padlock.

- A Financial Identity: Every transaction creates a history. In the old world, Amara was invisible. In the meCash ecosystem, she has a track record. She is building a financial footprint that proves she is creditworthy, reliable, and growing.

The Future is Inclusive

Financial inclusion is often talked about as “charity.” At meCash, we see it differently. We see it as opportunity.

When you empower a trader in Malawi to seamlessly do business with a partner in Rwanda, you aren’t just helping an individual; you are stitching together a fragmented continent. You are unlocking the billions of dollars currently sitting in the informal sector and bringing it into the light.

We are building a world where your location does not dictate your financial potential. Whether you are holding Kwacha, Naira, Shillings, or Francs, meCash ensures you have a seat at the table.

Join the revolution.

Download meCash and turn your local currency into global opportunity.