Explores the impact of new technologies on business-to-business transactions.

For decades, businesses engaged in international trade have grappled with a cross-border payments system that is often slow, expensive, and opaque. Traditional banking systems, with their reliance on correspondent banks and complex clearing processes, have long been the standard. However, this legacy infrastructure is fraught with challenges, including high transaction fees, unpredictable settlement times, and a lack of transparency that can strain business relationships and stifle growth.

Enter fintech. The rise of financial technology is not just a buzzword; it’s a fundamental shift that is actively dismantling the old barriers of international commerce. By leveraging cutting-edge technology, fintech companies are creating a new ecosystem for B2B cross-border payments—one that is faster, cheaper, and more secure than ever before.

The Core Problems with Traditional Payments

To understand the scale of the fintech revolution, it’s important to recognize the pain points of the old system:

- High Costs: Correspondent banks each take a fee for their part in the transaction, and poor exchange rates can further erode the value of a payment.

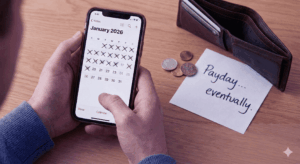

- Slow Speeds: A single international transfer can take several business days to clear, creating cash flow uncertainty for both the sender and the receiver.

- Lack of Transparency: Once a payment is sent, it can be difficult to track its progress, leading to uncertainty and administrative headaches.

- Complex Compliance: Navigating the regulatory requirements of different countries is a significant burden for businesses, especially small and medium-sized enterprises (SMEs).

How Fintech is Changing the Game

Fintech innovators are tackling these challenges head-on with a suite of solutions designed for the digital age. Here’s how they are revolutionizing B2B cross-border payments:

1. Digital Payment Platforms and Multi-Currency Accounts:

Modern payment platforms offer businesses the ability to hold, manage, and pay in multiple currencies from a single account. This eliminates the need for multiple foreign bank accounts and allows businesses to strategically manage their currency exposure. By using their own networks, these platforms can bypass the traditional correspondent banking system, resulting in significantly lower fees and faster transfers.

2. Blockchain and Distributed Ledger Technology (DLT):

Blockchain technology provides a secure and immutable ledger for recording transactions. For B2B payments, this means enhanced security and transparency. Transactions can be tracked in real-time by all authorized parties, reducing the risk of fraud and eliminating the need for intermediaries. This not only speeds up the process but also builds trust between trading partners.

3. Artificial Intelligence (AI) and Machine Learning:

AI is being deployed to automate many of the manual processes associated with international payments. This includes everything from data entry and invoice processing to sophisticated fraud detection and compliance checks. By analyzing vast amounts of data, AI can identify suspicious patterns and flag potential risks in real-time, providing a level of security that is simply not possible with manual oversight.

4. APIs and Embedded Finance:

Application Programming Interfaces (APIs) allow different software systems to communicate with each other. In the context of B2B payments, this enables the seamless integration of payment functionalities into existing business platforms, such as accounting software or enterprise resource planning (ERP) systems. This “embedded finance” approach streamlines workflows and makes managing international payments a natural part of a company’s day-to-day operations.

The Tangible Benefits for Businesses

The shift towards fintech-powered B2B payments offers a clear competitive advantage for businesses engaged in international trade:

- Reduced Costs: By cutting out intermediaries and offering better exchange rates, fintech solutions can save businesses a significant amount of money on every transaction.

- Improved Cash Flow: Faster settlement times mean that businesses get paid quicker, improving their cash flow and allowing them to reinvest in their operations sooner.

- Enhanced Relationships: The transparency and reliability of modern payment systems build trust with international partners, leading to stronger and more enduring business relationships.

- Greater Accessibility: Fintech platforms are often more accessible to SMEs than traditional banking services, leveling the playing field and enabling smaller businesses to compete on a global scale.

The Future is Here

The revolution in B2B cross-border payments is not a distant prospect; it’s happening right now. As technology continues to evolve, we can expect to see even more innovation in this space, with the potential for digital currencies and central bank digital currencies (CBDCs) to further transform the landscape.

For businesses looking to thrive in the global marketplace of 2025 and beyond, embracing these fintech solutions is no longer just an option—it’s a necessity. The future of international trade is being built on a foundation of speed, transparency, and efficiency, and fintech is leading the charge.