With the global cross-border payment market projected to exceed $250 trillion by 2027, the money you send, receive, and manage is part of the largest financial flow in human history.

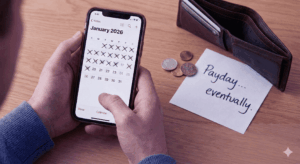

Your challenge in 2025 is to ensure that your share of this flow moves with maximum efficiency and minimal cost. The era of accepting opaque fees and week-long delays is over.

For the expanding business, the global freelancer, or the individual supporting family overseas, choosing a payment provider is no longer an administrative task; it is a strategic decision.

This guide provides a direct framework for selecting a cross-border payment partner that protects your assets and accelerates your financial operations in the advanced landscape of 2025.

1. The Anatomy of a Transfer: Uncovering the True Cost

Your primary focus must be the total cost, a figure often deliberately obscured. This cost is composed of two critical parts:

- Transfer Fees: These are the upfront charges, which can be a flat rate or a percentage of your transaction. Be wary of “fee-free” marketing, as these providers recoup their costs elsewhere.

- Exchange Rate Markups: This is the hidden profit center. Providers rarely offer the mid-market rate (the real exchange rate seen on Google or Reuters). Instead, they add a spread or “markup” to the rate they offer you. This markup is pure profit for them and a direct cost to you.

Your 2025 Playbook: Demand absolute transparency. Before committing to a transfer, use an independent online currency converter to find the current mid-market rate (check out meCash FX Calculator). Compare this to the provider’s offered rate to instantly calculate their markup. A trustworthy provider will clearly display their fee and the exact exchange rate you are getting. The ultimate test is always comparing the final amount the recipient will receive.

2. From Days to Seconds: Demanding Speed and Certainty

The 5-7 business day waiting period for international transfers is outdated. In 2025, propelled by Real-Time Payment (RTP) networks, speed is a given. The new benchmark is predictability.

- Traditional Banks (SWIFT): While dependably secure, the SWIFT network can still route payments through multiple intermediary banks, often taking several days and offering little in-progress visibility.

- Fintech Providers (e.g., meCash, Wise, Remitly, Payoneer): These platforms have built their reputation on speed, leveraging local payment networks to complete transfers in hours or even minutes.

Your 2025 Playbook: Look beyond the advertised speed and demand a guaranteed delivery time. For business-critical payments, knowing precisely when funds will land is essential for managing cash flow, inventory, and supplier trust.

3. Fortress-Level Security: Trust and Compliance are Non-Negotiable

Moving funds internationally means navigating a labyrinth of global regulations designed to combat fraud and money laundering. Your provider must be a fortress of security.

- Licensing and Regulation: Confirm the provider is licensed by a top-tier financial authority, such as the Financial Conduct Authority (FCA) in the UK, FinCEN in the US, or the equivalent in your jurisdiction.

- Data Security: Non-negotiable security standards include PCI DSS compliance for card processing and robust data protection, enforced through advanced encryption and mandatory two-factor authentication (2FA).

- Proactive Fraud Prevention: In 2025, leading providers are deploying sophisticated AI and machine learning algorithms to identify and neutralize fraudulent transaction patterns in real time, protecting you before a threat materializes.

4. Essential Features for Growth and Convenience

A provider should be a partner in your growth, not an operational bottleneck. Look for features that demonstrate they can scale with your needs.

- Global Corridors and Local Payouts: Ensure they service your specific country-to-country route (payment corridor). Critically, check the payout options. The ability to deliver funds directly to a local bank, a mobile money wallet (like M-Pesa), or a popular regional payment system (like PIX in Brazil or UPI in India) is a mark of a superior service.

- Business-Grade Tools: For businesses, a well-documented API is essential for integrating with your accounting software (e.g., Xero, QuickBooks) or e-commerce platform, enabling automated invoicing and reconciliation.

- Advanced Currency Management: The capacity to hold balances in multiple currencies allows you to receive payments and pay international suppliers without incurring conversion fees on every single transaction. For frequent international activity, a multi-currency account is a necessity. The ability to execute batch payments—paying multiple recipients at once—is a significant time-saver.

A Strategic Checklist for Your 2025 Decision

- Blueprint Your Requirements: Define your use case. Are you making a one-off personal transfer or recurring B2B payments? Note your average transaction size, key destinations, and frequency.

- Curate Your Contenders: Based on your required payment corridors, shortlist 2-3 highly-rated providers. For a true benchmark, include your traditional bank in the comparison.

- Execute a Cost Showdown: For a typical transfer amount, calculate the total cost (fee + exchange rate markup) for each contender.

- Verify Security Credentials: Scrutinize their website for licensing, regulatory compliance, and security protocols. Consult customer reviews on platforms like Trustpilot, focusing on reliability and support quality.

- Test the User Experience: Is the platform intuitive? Is the process of initiating a transfer transparent and simple? A clunky interface can be a red flag for backend inefficiency.

- Probe the Support System: What is their customer support structure? Is it limited to email, or do they offer 24/7 access via live chat and phone? A crisis doesn’t wait for office hours.

The cross-border payment landscape will continue its rapid evolution, with stablecoins and Central Bank Digital Currencies (CBDCs) promising even greater efficiency on the horizon. However, by using this framework to evaluate providers today, you can confidently select a partner that is secure, cost-effective, and powerful enough to meet the demands of tomorrow.