For years, the dream for any Nigerian startup founder was to ring the bell on the New York Stock Exchange. But the dream is changing. Now, a different kind of deal is becoming the new definition of success: getting acquired.

For a long time, the ultimate goal for a tech startup was an Initial Public Offering (IPO), selling shares to the public. It was seen as the final proof that you had truly made it. But lately, especially in Nigeria, that goal seems further away than ever.

Instead, a new trend is taking over: Mergers and Acquisitions (M&A). Rather than going public, successful startups are being bought by bigger companies.

So, why is the IPO dream fading, and why is selling the company now the smartest move for many founders?

The IPO Dream is on Ice

Going public sounds glamorous, but right now, it’s incredibly difficult. Here’s why:

- Investors are Nervous: Globally, the stock market has been shaky. Investors are playing it safe and are not as willing to bet on new tech companies as they were a few years ago. This has led to the fewest tech IPOs in years.

- It’s Expensive and Hard: Getting a company ready for an IPO is a mountain of work. It costs millions of dollars in legal and banking fees. For Nigerian startups, trying to list on a US stock exchange means even more hurdles and costs.

- The Trust Issue: Past controversies involving Nigerian firms have made international investors more cautious. This extra scrutiny makes a US IPO even harder to pull off. One expert put it bluntly: the path to a US listing for African startups is “a very tough, narrow, and expensive road.”

Why Acquisition Makes More Sense Now

With the path to an IPO blocked, many startups are finding that being acquired is a great alternative. This shift is happening for a few key reasons:

- Tough Economic Times: Nigeria’s economy, with its high inflation and currency challenges, has made it difficult for many startups to grow. When money is tight, joining forces with a larger, more stable company can be a lifeline.

- A Crowded Market: The fintech space in Nigeria is packed. Many companies are fighting for the same customers. By combining, they can cut costs, share users, and become stronger. We’re seeing the market naturally start to shrink as bigger players buy up smaller ones.

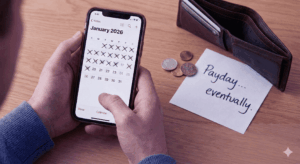

- A Faster Path to a Payday: For the people who invested money in these startups early on (Venture Capitalists or VCs), M&A is a good thing. They don’t have to wait years for a risky IPO to get their money back. A sale provides a clear and often faster return on the investment.

The Story of Brass: A Perfect Example

The recent acquisition of Brass shows exactly how this is playing out. Brass offered banking services for small businesses and was once a rising star. But it ran into serious financial trouble.

Paystack, a giant in the payments world, led a group to buy the struggling company. For Paystack, this wasn’t about charity. They gained Brass’s valuable customer base and unique software, allowing them to expand their services without having to build everything from scratch.

For Brass, the deal was a rescue mission that saved the company from shutting down completely. It was a practical solution to a difficult problem.

What This Means for Startups and Investors

This trend is changing the game for everyone involved:

- For Founders: The goal is no longer just about building a huge, independent company. It’s now also about building something valuable that a bigger company might want to buy. This might mean focusing on a specific niche or technology that complements a larger player in the market. An exit through a sale is now seen as a major success.

- For Investors: VCs are also adjusting their plans. They are now more likely to fund startups that have a clear potential to be acquired. As one investor said, “Consolidation is the name of the game… We’ll see more M&A.”

The New Reality

The dream of a splashy IPO on Wall Street hasn’t completely disappeared, but for most Nigerian startups, it’s no longer the most realistic goal. The market has matured, and the new finish line is often a strategic sale to a bigger company.

This shift isn’t a sign of failure. It’s a sign of a smart, adaptable tech scene that understands how to survive and succeed in a challenging environment. In today’s Nigeria, getting acquired isn’t just an exit strategy. It’s a powerful strategy for growth.

Where meCash fits in

At meCash, we believe this new reality isn’t something to fear—it’s an opportunity. Our platform is built to help founders and investors create real, lasting value that stands out in a crowded market. Whether it’s scaling smarter, managing resources better, or positioning your business for the right partnerships, meCash is here to help you build something acquisition-ready—or sustainable enough to thrive on its own.

Ready to build a startup that attracts the right kind of attention? Partner with meCash today and take the smarter path to growth.