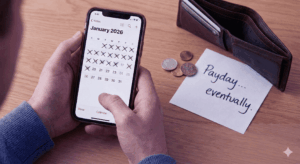

Life is full of surprises — some pleasant, others expensive. A burst water pipe, sudden medical bill, or job loss can throw anyone off balance, especially if there’s no financial cushion.

That’s why an emergency fund is one of the most powerful tools for achieving peace of mind and financial stability.

In many African countries, where income can be irregular and the cost of living keeps rising, an emergency fund isn’t just a nice-to-have — it’s essential.

An emergency fund is simply a stash of money you set aside specifically for unexpected life events. It’s your personal safety net, giving you the freedom to handle a crisis without derailing your long-term goals.

Why an Emergency Fund Matters in Africa

Across the continent, millions of people rely on informal work, side hustles, or small businesses. While these create opportunities, they also mean income can fluctuate. Add inflation, currency swings, or unexpected family obligations, and it’s easy to see why savings are vital.

An emergency fund helps you:

- Cover urgent expenses without borrowing at high interest.

- Avoid selling valuable assets in distress.

- Keep long-term investments intact, even during crises.

- Reduce stress and focus on solutions instead of panic.

Your 5-step guide to building a powerful emergency fund

Ready to build your safety net? You can do it! Just follow these simple steps.

Step 1: Set your safety goal

Financial experts recommend saving 3 to 6 months’ worth of essential living expenses. This includes rent, food, transport, utilities, and other non-negotiables.

Feeling overwhelmed? Don’t be! Start with a smaller, more achievable goal. Let’s call it your “starter fund.”

- Mini-goal example: Aim to save a specific amount, like a week’s or a month’s wages. Once you hit that, celebrate your win and set the next target!

Quick calculation: If your basic monthly expenses are 100,000 units of your local currency, your 3-month goal is 300,000. You can start by aiming for your first 50,000.

Step 2: Choose the right place for your stash

You need to keep this money safe and accessible, but not too accessible. This helps you avoid dipping into it for everyday wants. Here are some great options available across Africa:

- Mobile money wallets: Use a separate wallet on a trusted mobile money platform. Some services even have features to lock your savings for a set period.

- Digital savings apps: Certain apps are designed to help you save automatically and may offer better interest rates than traditional banks.

- SACCOs or cooperative societies: These community-based organizations are fantastic for disciplined saving and often provide members with low-interest loans if a larger emergency strikes.

- A separate bank account: Open a basic, low-fee savings account at a local bank. The key is that it shouldn’t be your main account for daily transactions.

Step 3: Automate and commit

Don’t rely on willpower alone! You can save more easily if you make it automatic.

- Set up automatic transfers: Schedule a small, fixed amount to move from your main account to your savings account every payday.

- Join a rotating savings group (Ajo/Chama/Tontine): These traditional savings circles are a powerful way to build discipline and community support.

- Use the “envelope” method: If you deal mostly in cash, physically set aside a portion of your income in a designated envelope and put it somewhere safe.

Step 4: Protect your fund like a fortress

This money has one job: to protect you during an emergency. It is NOT for:

- A holiday trip

- A new phone (unless your current one is essential for work and breaks)

- A wedding gift

- A great deal on shoes

Label your savings account “EMERGENCY ONLY” to remind yourself of its purpose.

Step 5: Reassess and grow

Your life isn’t static, and your emergency fund shouldn’t be either. Review your savings goal once a year, or whenever your financial situation changes, like a pay rise or a new baby.

As your income grows, increase your automatic savings amount. With inflation, the cost of living goes up, so your safety net needs to grow with it.

Pro tips for success

- Start small, stay consistent: Even saving a small amount every week is a fantastic start. Consistency is more important than the amount.

- Trim the fat: Temporarily cut back on one discretionary expense—like daily data bundles or eating out—and redirect that money to your fund.

- Use “found” money: If you get a bonus at work, a tax refund, or a windfall from a side hustle, send at least half of it directly to your emergency fund before you have a chance to spend it.

Pitfalls to avoid

- Mixing savings with investments: Do not put your emergency fund in high-risk investments like stocks or crypto. You need this money to be stable and available when you need it most.

- Dipping in for non-emergencies: Be strict with yourself! Ask: “Is this urgent and unexpected?” If not, it’s not an emergency.

Your future self will thank you

Building an emergency fund is one of the most powerful acts of self-care you can do. It’s your ticket to financial resilience and a future with fewer worries. Don’t wait for the “perfect” time. Take the first step today.

Ready to start saving? A great way to keep your emergency fund separate and secure is by using a dedicated account. With a meCash virtual account, you can easily set aside funds, track your progress, and manage your money safely.

Sign up for meCash today and take control of your financial future!