If you are a business owner in Lagos, Lilongwe, Nairobi, or Kigali, you know the frustration of trading within Africa.

It is an irony of modern African business: it is often easier to pay a supplier in China or the US than it is to pay a partner just a few borders away. If you are holding Naira (NGN) and need to pay a supplier in Malawian Kwacha (MWK), or if you are a Kenyan business needing to settle an invoice in Rwanda (RWF), you are likely forced into the “Dollar Trap.”

You convert your local currency to USD (losing money), send it via a slow wire transfer (losing time), and your recipient converts it back to their local currency (losing money again).

The future of business wallets isn’t just about holding Dollars; it’s about holding Africa. Here is how multi-currency accounts for MWK, NGN, KES, and RWF are changing the game.

The “Dollar Trap” in Intra-African Trade

For years, the US Dollar has been the painfully expensive bridge between African currencies.

The Old Way (How You Lose Money):

Imagine a Nigerian logistics company paying a partner in Kenya.

- Step 1: You sell NGN to buy USD (paying a high exchange rate).

- Step 2: You wire the USD (paying swift fees + waiting 3-5 days).

- Step 3: Your Kenyan partner receives USD and sells it to buy KES (paying another spread).

The Result: You lose 5-15% of the transaction value to banks, just to move money across the continent.

The Solution: Direct Local Settlements

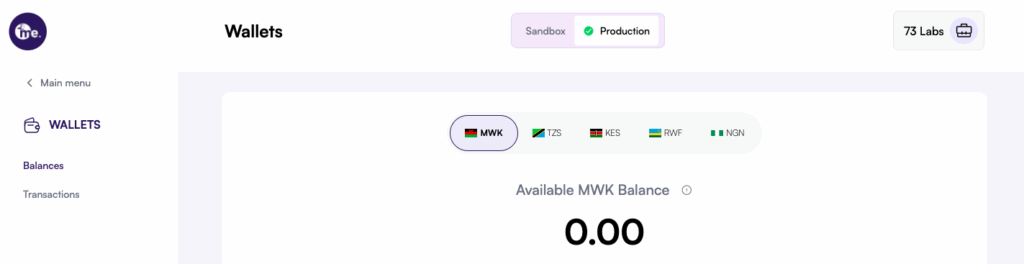

The new generation of business wallets—led by meCash—removes the middleman currency. By offering dedicated wallets for Malawian Kwacha (MWK), Nigerian Naira (NGN), Kenyan Shilling (KES), and Rwandan Franc (RWF), you can finally trade directly.

1. Hold Multiple African Currencies at Once

A true multi-currency wallet allows you to hold balances in MWK, NGN, KES, and RWF simultaneously.

- Why this matters: If you have revenue coming in from Rwanda, you don’t need to convert it immediately. You can hold that RWF in your wallet and use it to pay your next expense in Kigali. This is a “natural hedge” that saves you 100% of conversion fees.

2. Pay Like a Local, Anywhere

When you have a wallet that supports these specific corridors, you can pay a supplier in Malawi directly in MWK, or a partner in Kenya in KES. To them, it looks like a local bank transfer. It settles faster, and the fees are a fraction of international wire costs.

Product Spotlight: The meCash African Advantage

At meCash, we don’t just support global currencies; we specialize in African connectivity. We have built the infrastructure to make moving money between Nigeria, Malawi, Kenya, and Rwanda as easy as sending a text.

Here is how our wallet empowers businesses in these four key markets:

🇲🇼 For Business in Malawi (MWK)

Stop struggling with FX scarcity. With meCash, you can receive MWK from local clients and settle international suppliers seamlessly. We bridge the gap that traditional Malawian banking often struggles to fill.

🇳🇬 For Business in Nigeria (NGN)

Nigerian businesses are the heartbeat of African trade. Use your meCash NGN wallet to pay partners in East Africa without sourcing scarce Dollars first. We handle the settlement so you can focus on speed.

🇰🇪 For Business in Kenya (KES)

Whether you are a freelancer or a logistics firm, your meCash wallet gives you a global presence. Receive KES instantly and convert to NGN or RWF only when you decide the time is right.

🇷🇼 For Business in Rwanda (RWF)

As a growing hub for innovation, Rwandan businesses need agility. meCash allows you to accept payments from partners in West and East Africa directly into your RWF wallet, bypassing slow correspondent banks.

The Bottom Line

If your business operates across African borders, your bank account shouldn’t act like a border control checkpoint.

Stop paying the “Dollar Tax” on every transaction. By using a wallet that natively understands MWK, NGN, KES, and RWF, you keep your profit where it belongs: in your business.

Ready to trade without borders?

Create your free meCash Business account today and start sending, holding, and receiving the currencies that matter to your business.