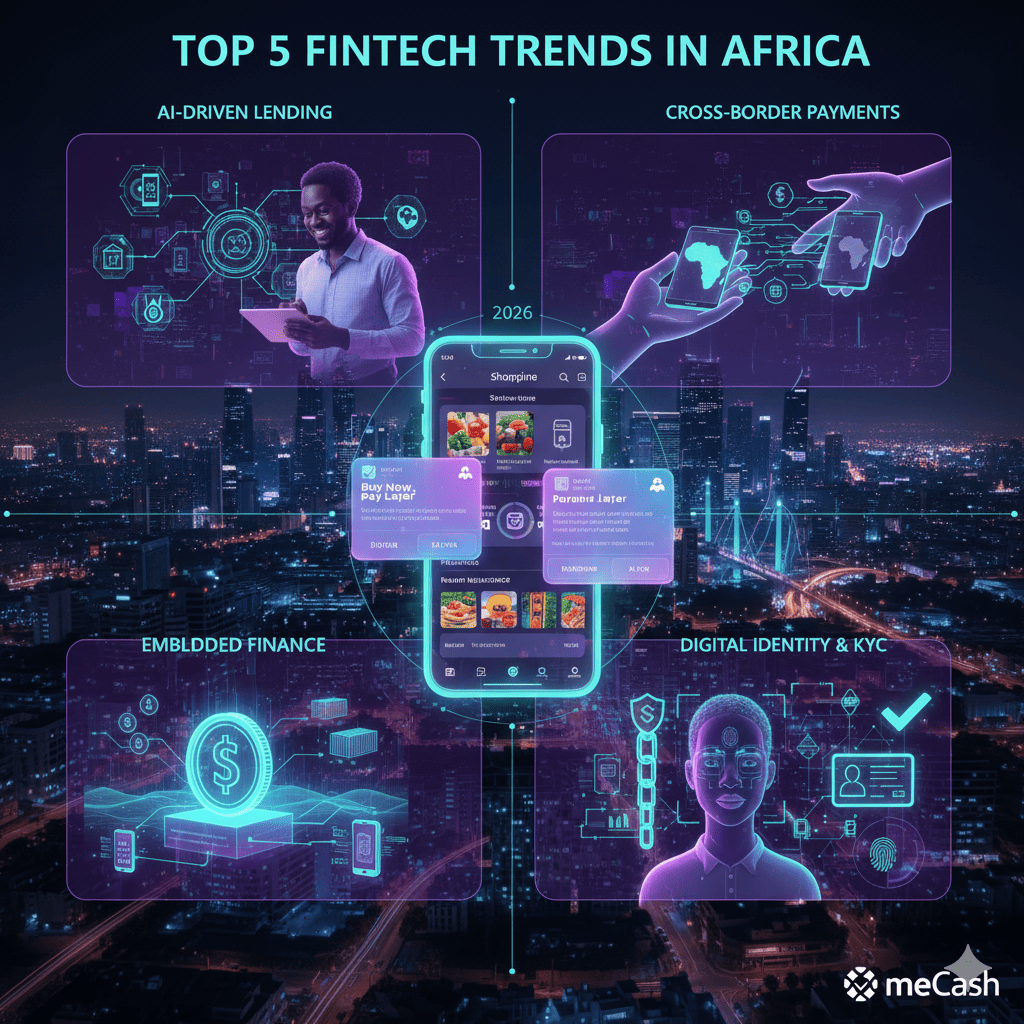

Africa’s financial technology (fintech) landscape is not just growing; it’s exploding. With a youthful population, increasing smartphone penetration, and a pressing need for accessible financial services, the continent has become a hotbed for innovation. As we step into 2026, the pace of change is accelerating, making this a pivotal year for observing shifts that will redefine how money moves, how businesses operate, and how individuals access financial tools.

This year, several powerful trends are converging to reshape Africa’s fintech future. Understanding these shifts is key to unlocking new opportunities and staying ahead in a dynamic market.

1. AI-Driven Lending and Credit Scoring

Access to credit remains a significant challenge for individuals and small businesses across Africa, largely due to a lack of traditional credit history. In 2026, Artificial Intelligence (AI) is set to revolutionize this. AI-driven lending platforms are moving beyond conventional metrics, using vast amounts of alternative data – from mobile money transactions and utility bill payments to social media activity – to build robust credit profiles.

Impact: This trend is dramatically expanding financial inclusion by making credit accessible to the previously unbanked and underbanked. For businesses, it means quicker access to working capital, fostering growth and innovation. AI algorithms can assess risk more accurately and efficiently, leading to faster loan approvals and more personalized financial products.

2. The Rise of Seamless Cross-Border Payments

Sending and receiving money across African borders, or from the diaspora, has historically been slow, expensive, and complex. However, 2026 is the year of seamless cross-border payments. New fintech solutions are leveraging technology to bypass traditional correspondent banking networks, offering instant, low-cost, and transparent transfers.

Impact: This is a game-changer for individuals supporting families across borders and for businesses engaged in intra-African trade. It reduces remittance costs, boosts trade efficiency, and integrates African economies more deeply into the global financial system. The ability to move money effortlessly strengthens economic ties and fosters greater financial fluidity.

3. Embedded Finance Everywhere

Imagine applying for a loan directly within your e-commerce app, or buying insurance as part of your ride-sharing service. This is embedded finance, and it’s set to become pervasive in Africa by 2026. This trend integrates financial services directly into non-financial platforms, making them contextually relevant and incredibly convenient.

Impact: Embedded finance makes financial services invisible and effortless, meeting users where they already are. For consumers, it means greater convenience and access to tailored financial products at the point of need. For businesses, it offers new revenue streams and deeper customer engagement by transforming their existing platforms into financial hubs, creating a more holistic user experience.

4. Stablecoins for Real-World Utility

While cryptocurrencies have seen volatile swings, stablecoins – digital currencies pegged to stable assets like the US dollar – are emerging as a pragmatic solution for real-world financial transactions in Africa. In 2026, expect to see their increased adoption for cross-border trade, remittances, and even local payments, especially in economies experiencing currency fluctuations.

Impact: Stablecoins offer a stable, fast, and low-cost alternative for moving value, mitigating foreign exchange risks, and facilitating international business without the volatility associated with other digital assets. They provide a bridge between traditional finance and the decentralized economy, offering a new layer of efficiency and accessibility for both individuals and businesses.

5. Digital Identity and KYC Innovations

The foundation of secure and inclusive financial services is robust identity verification. In 2026, we will see significant advancements in digital identity and Know Your Customer (KYC) innovations across Africa. Solutions utilizing biometrics, AI-powered document verification, and blockchain are streamlining the onboarding process, making it faster, more secure, and accessible for those without traditional identification documents.

Impact: Enhanced digital identity solutions are crucial for financial inclusion, enabling more people to access formal financial services securely. For fintech providers, it means reducing fraud, improving compliance, and significantly lowering the cost and friction associated with customer onboarding. This trend underpins the growth of all other fintech advancements by creating a trusted digital ecosystem.

meCash: Empowering Africa’s Fintech Future

The year 2026 promises to be a transformative period for fintech in Africa, driven by these powerful trends. At meCash, we are not just observing these shifts; we are actively building solutions that empower individuals and businesses to thrive within this evolving landscape. Our commitment is to leverage these innovations to provide secure, accessible, and efficient financial services, ensuring our users are perfectly positioned to benefit from Africa’s vibrant digital future.