The Future of Business Wallets: Why Your Wallet Needs to Speak “African

If you are a business owner in Lagos, Lilongwe, Nairobi, or Kigali, you know the frustration of trading within Africa. It is an irony of modern African business: it is often easier to pay a supplier in China or the US than it is to pay a partner just a few borders away. If you […]

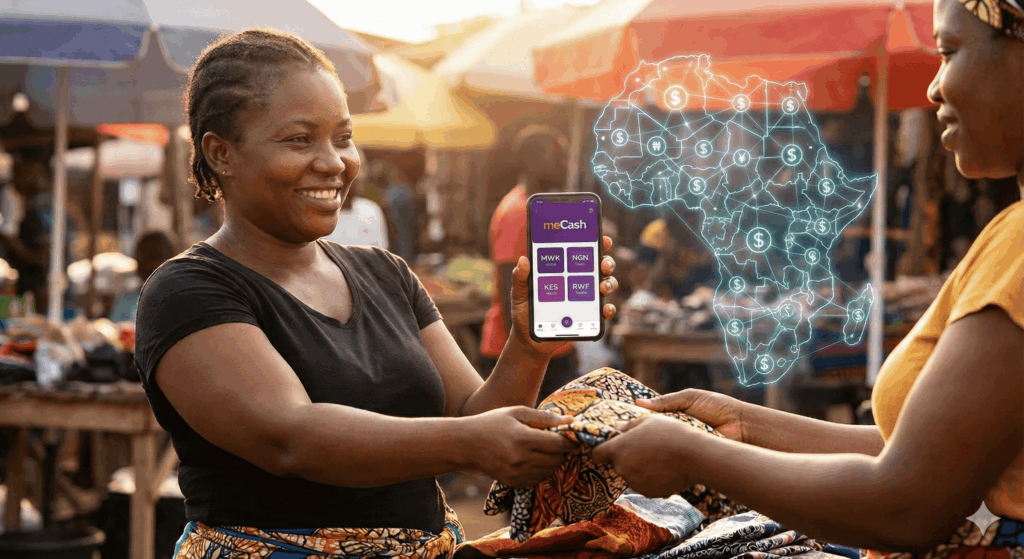

Beyond Borders: How meCash is Unlocking the Hidden Potential of Africa’s Informal Economy

Imagine Chimwala. She runs a small textile business in a bustling market in Lilongwe, Malawi. For years, Chimwala’s business existed entirely in physical cash—Malawian Kwacha (MWK). Every sale was a handshake, and every saving was a banknote tucked away in a lockbox. She was what economists call “unbanked” or “underbanked.” But Chimwala had a problem. […]

Black Friday Rush: How to Pay Your International Suppliers (in US, UK) Instantly

This is it. The Black Friday and Cyber Monday sales rush is on. Your suppliers in US, and the UK have just dropped their “limited-time” stock deals. You find the perfect inventory at a fantastic price, but there’s a catch: the deal expires in 24 hours, and hundreds of other businesses want it, too. You […]

How to Send Holiday Cash to Family in Nigeria, Ghana, and Kenya

The holiday season is here. It is a time for connection, celebration, and showing love, even across continents. You want to send a gift back home to your family in Lagos, Accra, or Nairobi, but you dread the process. Long queues, confusing forms, shockingly high fees, and worrying if the money will arrive in time […]

API Integration Explained: Connect Your Business with meCash Easily

With the meCash API, you can connect international payments, currency conversion, and virtual accounts directly into your own systems — letting your business move money globally with ease. This guide covers: Why Integrate with meCash? Integrating directly with the meCash API unlocks a suite of strategic advantages that can transform your financial operations. Here’s how […]

How to choose the right payment partner for your business

In today’s global market, choosing the right payment partner can shape your business’s success. Whether you’re a startup, an SME, or an established company expanding across borders, your payment infrastructure affects your costs, cash flow, and customer trust. From traditional banks to fintech innovators and wallet platforms, the choices can feel overwhelming. Let’s look at […]

Stablecoins and the Future of Cross-Border Payments in Africa

Cross-border payments in Africa have traditionally been slow, costly, and complicated. Bank transfers often take several days to settle, and remittance fees can exceed 6–8 percent, cutting deeply into the money that families and small businesses receive. Many entrepreneurs also face difficulties collecting international payments because of limited banking access or restrictive compliance procedures. A […]

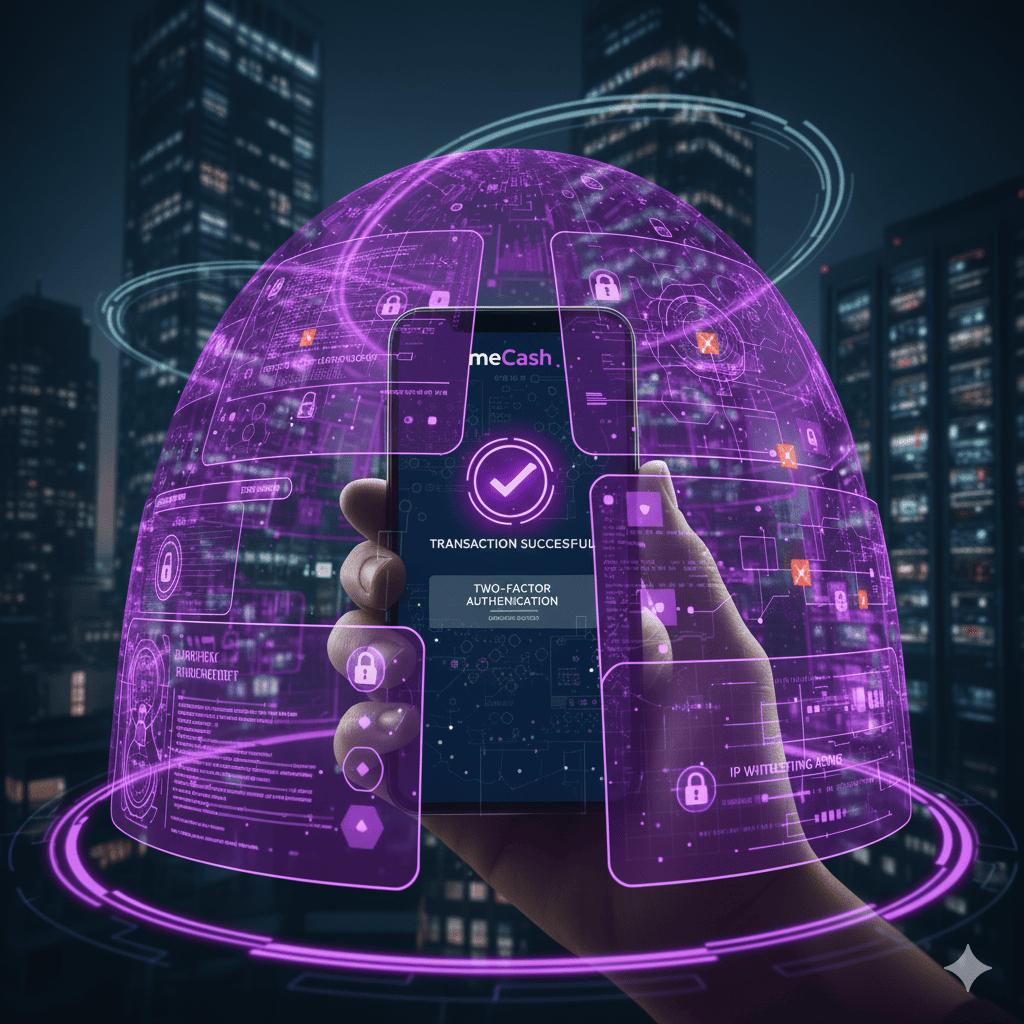

Your Security is Our Priority: A Look at meCash’s Safety Features

In the summer of 2025, a credit union in the United States announced a major data breach. Hackers accessed its systems and exposed the highly sensitive information of over 172,000 members, including their names, account numbers, and even Social Security numbers. This real-life event is a stark reminder of why trust is the most valuable […]

Bridging the gap: How fintech is revolutionizing financial access in Africa

For millions across Africa, basic financial services have long been out of reach. Imagine living hours away from the nearest bank, facing high fees for simple transactions, or being a small business owner unable to accept payments from customers abroad. This is the reality of financial exclusion, a persistent challenge that has limited economic growth […]

meCash for Business: Streamlining your cross-border payments

Running a modern business means thinking globally. You might have a key supplier in Asia, a talented freelancer working from another continent, or customers an ocean away. While the opportunities are exciting, the financial logistics can be a real headache. Slow, expensive bank wires and messy paperwork can quickly take the focus away from what […]