meCash Blog

Democratising access to global financial services for Africans.

Articles

The Federal Republic of Nigeria has enacted a significant piece of fiscal legislation, the Nigeria Tax Act, 2025. This Act represents a landmark...

Cross-border payments in Africa have traditionally been slow, costly, and complicated. Bank transfers often take several days to settle, and...

Life is full of surprises — some pleasant, others expensive. A burst water pipe, sudden medical bill, or job loss can throw anyone off balance...

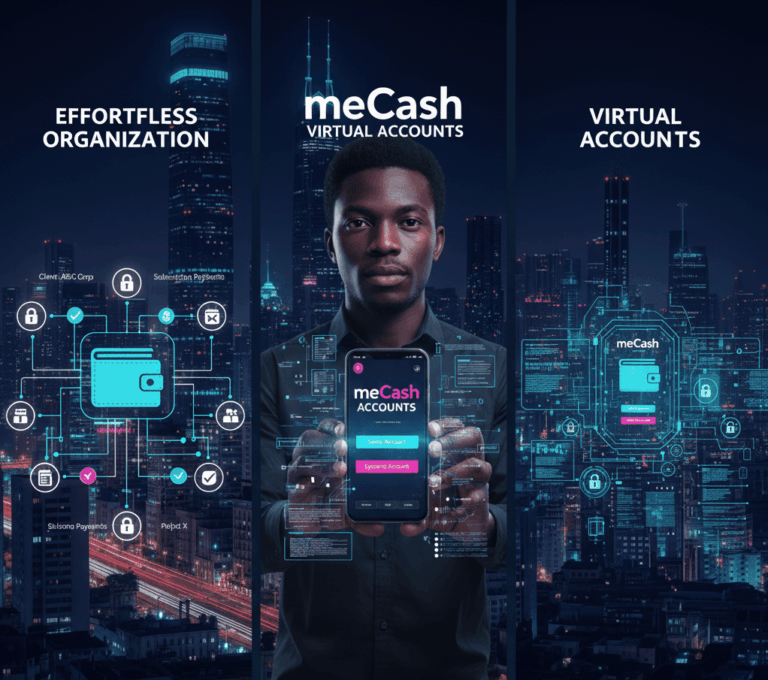

Imagine having a dedicated account number for each client, or a unique one for every invoice you send, without the complexity and paperwork of opening...

Have you ever tried to send money from Lagos to Accra? It shouldn’t feel like launching a rocket. It shouldn’t cost a huge chunk of what...

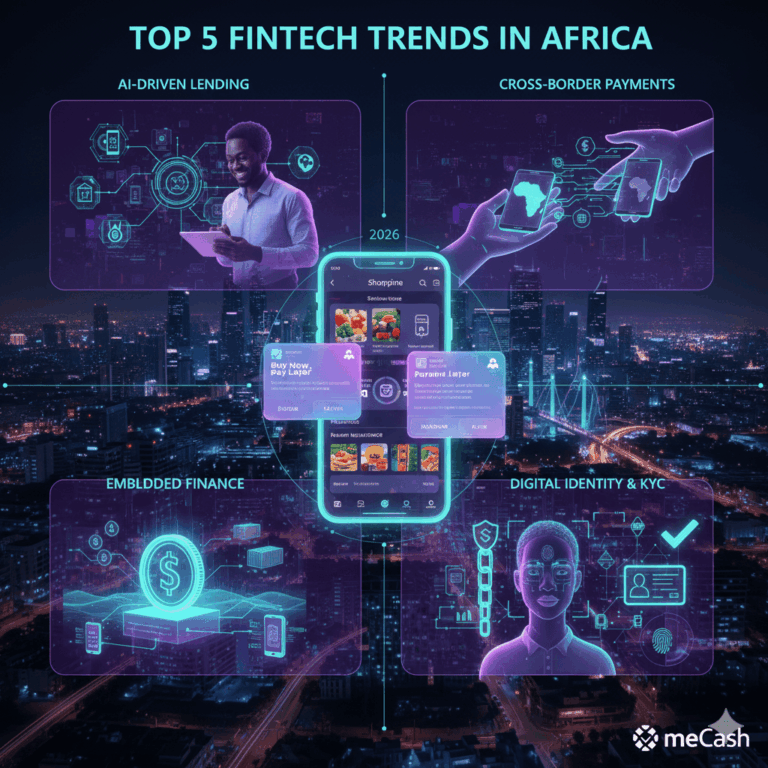

Africa’s financial technology (fintech) landscape is not just growing; it’s exploding. With a youthful population, increasing smartphone...

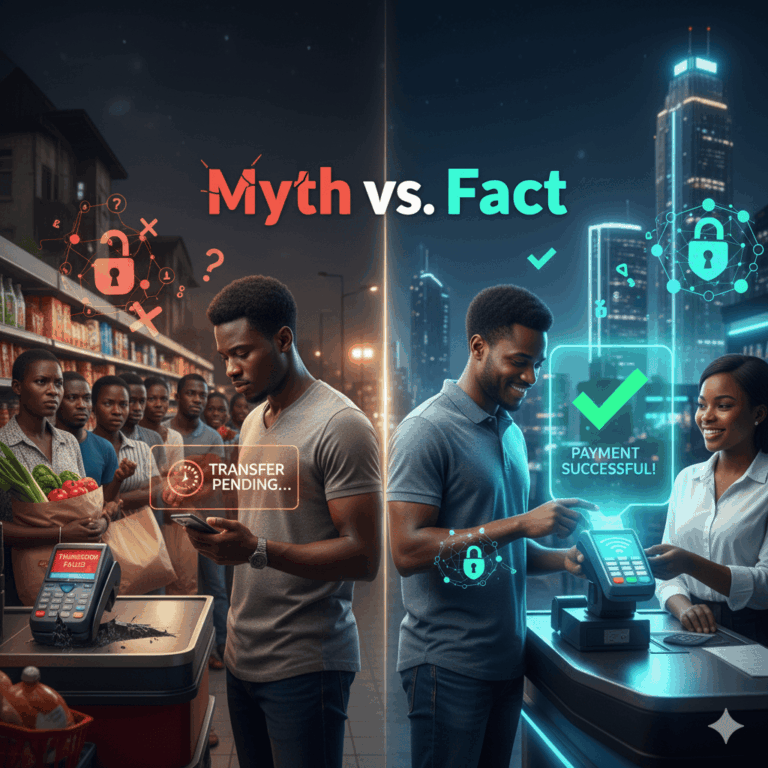

Let’s be honest for a second. Remember when ATMs first showed up? People were scared. “It will swallow my card!” “What if it gives me fake...

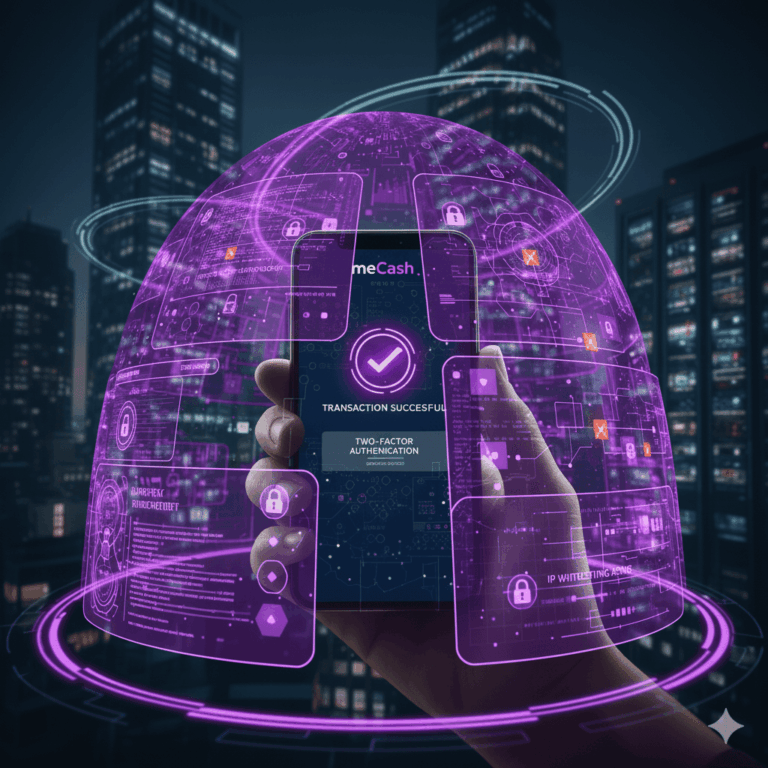

In the summer of 2025, a credit union in the United States announced a major data breach. Hackers accessed its systems and exposed the highly...

For millions across Africa, basic financial services have long been out of reach. Imagine living hours away from the nearest bank, facing high fees...