Cross-border payments in Africa have traditionally been slow, costly, and complicated.

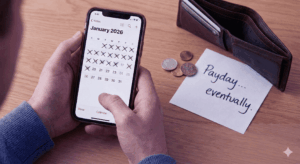

Bank transfers often take several days to settle, and remittance fees can exceed 6–8 percent, cutting deeply into the money that families and small businesses receive.

Many entrepreneurs also face difficulties collecting international payments because of limited banking access or restrictive compliance procedures.

A new class of digital assets, known as stablecoins, is emerging as a potential solution to these challenges.

By combining the efficiency of blockchain technology with the stability of traditional currencies, stablecoins could make sending and receiving money across borders faster, cheaper, and more accessible.

Understanding Stablecoins

A stablecoin is a type of cryptocurrency designed to maintain a steady value, usually pegged to a fiat currency such as the US dollar, the euro, or another reserve asset.

Unlike highly volatile digital assets like Bitcoin or Ether, stablecoins aim to keep their price close to the reference value that backs them.

Stablecoins generally fall into three categories:

- Fiat-backed stablecoins: These coins, such as USDC or USDT, are backed one-to-one by reserves held in banks or other custodial accounts.

- Crypto-collateralized stablecoins: These use other cryptocurrencies as collateral and keep the system over-collateralized to absorb price swings. An example is DAI.

- Algorithmic stablecoins: These rely on supply-and-demand mechanisms to maintain their peg. They are less common due to the higher risk of losing their price stability.

By anchoring their value to reliable assets, stablecoins combine the predictability of money with the rapid transfer capability of blockchain networks.

Why Stablecoins Matter for Africa’s Cross-Border Payments

African countries face unique challenges in moving money across borders. Traditional banking infrastructure can be fragmented, while international transfers often pass through several intermediary banks before reaching the final recipient. This process adds cost and delays, especially for low-value transactions.

Stablecoins can address these issues in several ways. They enable near-instant settlement because transactions take place directly on a blockchain rather than through a chain of correspondent banks. This speed allows businesses and individuals to access funds within minutes rather than days.

They also reduce transaction costs. Blockchain fees are typically far lower than the charges levied by banks and money transfer operators, which means people keep more of their earnings when they send money home or pay for services abroad.

Stablecoins can also expand access. Millions of Africans rely on mobile money or fintech apps rather than traditional bank accounts. Because stablecoins can integrate with these platforms, they open international payment channels to people who previously could not participate in global commerce.

Finally, stablecoins increase transparency. Public blockchains record every transaction, allowing participants to verify transfers and reducing opportunities for fraud.

Real-World Use Cases in Africa

Several applications are already taking shape across the continent. Migrant workers use dollar-pegged stablecoins such as USDC to send remittances directly to their families. The recipients can then convert the funds into local currencies through mobile money agents or crypto exchanges.

Small and medium-sized enterprises also benefit. Importers use stablecoins to pay suppliers abroad, avoiding long delays and high fees associated with correspondent banking. Some individuals employ stablecoins as a hedge against inflation, preserving their purchasing power in economies where local currencies depreciate quickly.

Challenges That Must Be Addressed

Despite their promise, stablecoins face practical hurdles in Africa. Regulation remains a significant issue, as governments and central banks work to design appropriate frameworks for digital assets. Without clear rules, businesses and individuals may hesitate to adopt these tools.

Access points between stablecoins and local currencies, known as on- and off-ramps, need to become cheaper and more secure. Users also require education on how to store private keys, safeguard their wallets, and identify legitimate providers. Building trust through transparency, robust security measures, and community outreach is essential.

Looking Toward the Future

Stablecoins are not a cure-all, but they offer Africa a powerful opportunity to modernize cross-border payments. As policymakers, fintech companies, and mobile money operators collaborate, the continent could bypass outdated systems and create a more inclusive financial network.

By understanding and embracing stablecoins now, businesses, workers, and families can position themselves to benefit from a future where sending and receiving money across Africa — or anywhere in the world — is faster, more affordable, and within everyone’s reach.